san francisco sales tax rate

How much is sales tax in San Francisco. The San Francisco sales.

:max_bytes(150000):strip_icc()/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

The current total local sales tax rate in South San Francisco CA is 9875.

. The current total local sales tax rate in San Francisco CA is 8625. The current total local sales tax rate in San Francisco CA is 8625. What is the sales tax rate in South San Francisco California.

In most areas of California local jurisdictions have added district taxes that. Nearby homes similar to 739 Colby St have recently sold between 980K to 1753K at an average of 1105 per square foot. San Francisco County California Sales Tax Rate 2022 Up to 9875.

1125 Goettingen St SAN FRANCISCO CA 94134. The December 2020 total local sales tax rate was 8500. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

The County sales tax rate is. The minimum combined 2022 sales tax rate for South San Francisco California is. The California sales tax rate is currently 6.

San Francisco Proposition L is on the ballot as a referral in San Francisco on November 8 2022. You can print a 9875 sales tax table here. This is the total of state and county sales tax rates.

This includes the rates on the state county city and special levels. Within San Francisco there are around 39 zip codes with the most populous zip. Our GIS-based sales tax.

This is the total of state county and city sales tax rates. The current total local sales tax rate in San. CDTFA public counters are open for scheduling of in-person video or phone.

Choose Avalara sales tax rate tables by state or look up individual rates by address. The minimum combined 2022 sales tax rate for San Francisco California is. A yes vote supports continuing an existing one-half cent sales tax through 2053 for transportation project funding and allowing the Transportation Authority to issue up to 191 billion in bonds.

This is the total of state county and city sales tax rates. The County sales tax rate is 025. SOLD MAY 17 2022.

This is the total of state county and city sales tax rates. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

For tax rates in other cities see California sales taxes by city. Please visit our State of Emergency Tax Relief page for additional information. The California sales tax rate is currently.

What is the sales tax rate in San Francisco California. The current total local sales tax rate in San. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

The statewide tax rate is 725. There is no applicable city tax. 1170000 Last Sold Price.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. San Francisco has parts of it located within San Mateo County. The minimum combined sales tax rate for San Francisco California is 85.

This is the total of state county and city sales tax rates. The California state sales tax rate is currently. Those district tax rates range from 010 to 100.

What is San Francisco sales tax rate 2020. The average cumulative sales tax rate in San Francisco California is 864. The minimum combined sales tax rate for San Francisco California is 85.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The December 2020 total local sales tax rate was 8500. The current total local sales tax rate in San Francisco County CA is 8625.

The California sales tax rate is currently 6. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. The December 2020 total local sales tax rate was 9750.

What is San Francisco sales tax rate 2020. The statewide tax rate is 725. Some cities and local governments in San Francisco County collect additional local sales.

Sellers are required to report and. The minimum combined sales tax rate for San Francisco California is 85. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

The San Francisco County sales tax rate is. What is CA sales tax. The minimum combined 2022 sales tax rate for San Francisco County California is.

The California sales tax rate is currently 6. 0875 lower than the maximum sales tax in CA. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

Nearby Recently Sold Homes. This is the total of state county and city sales tax rates. The sales tax jurisdiction name is San Francisco.

The California sales tax rate is currently. The December 2020 total local sales tax rate was 8500. The 2018 United States Supreme Court decision in South.

The County sales tax rate is. Some areas may have more than one district tax in effect.

Understanding California S Sales Tax

How To Use A California Car Sales Tax Calculator

Bay Area S Missing Billions San Francisco Business Times

No More Deals San Francisco Considers Raising Taxes On Tech Wired

Local Income Taxes In 2019 Local Income Tax City County Level

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Frequently Asked Questions City Of Redwood City

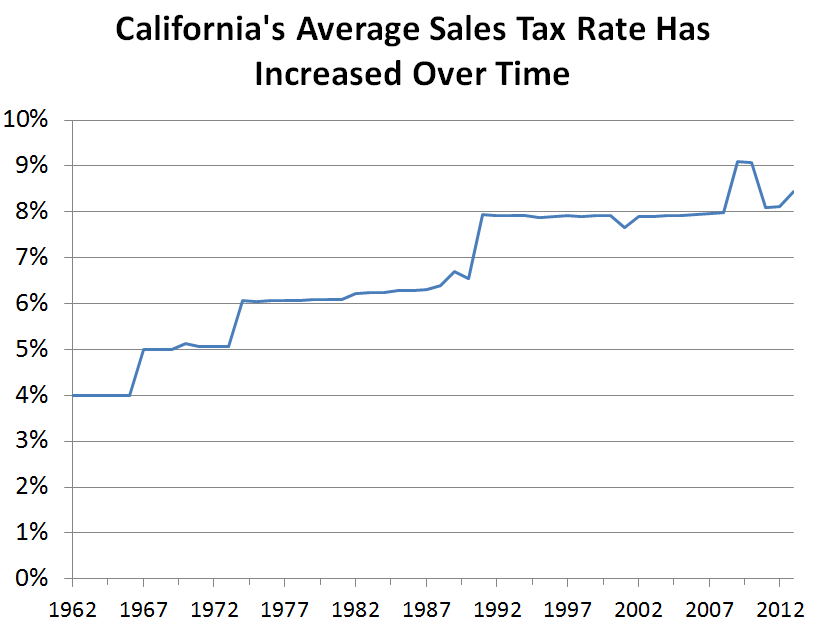

California S Sales Tax Rate Has Grown Over Time Econtax Blog

California State Sales Tax Rate Change January 2017 Avalara

California Sales Tax Rate Changes January 2013 Avalara

Washington S Combined Average State Local Sales Tax Rate Of 8 92 Is Nation S 5th Highest California Has Highest State Rate Opportunity Washington

How Do State And Local Soda Taxes Work Tax Policy Center

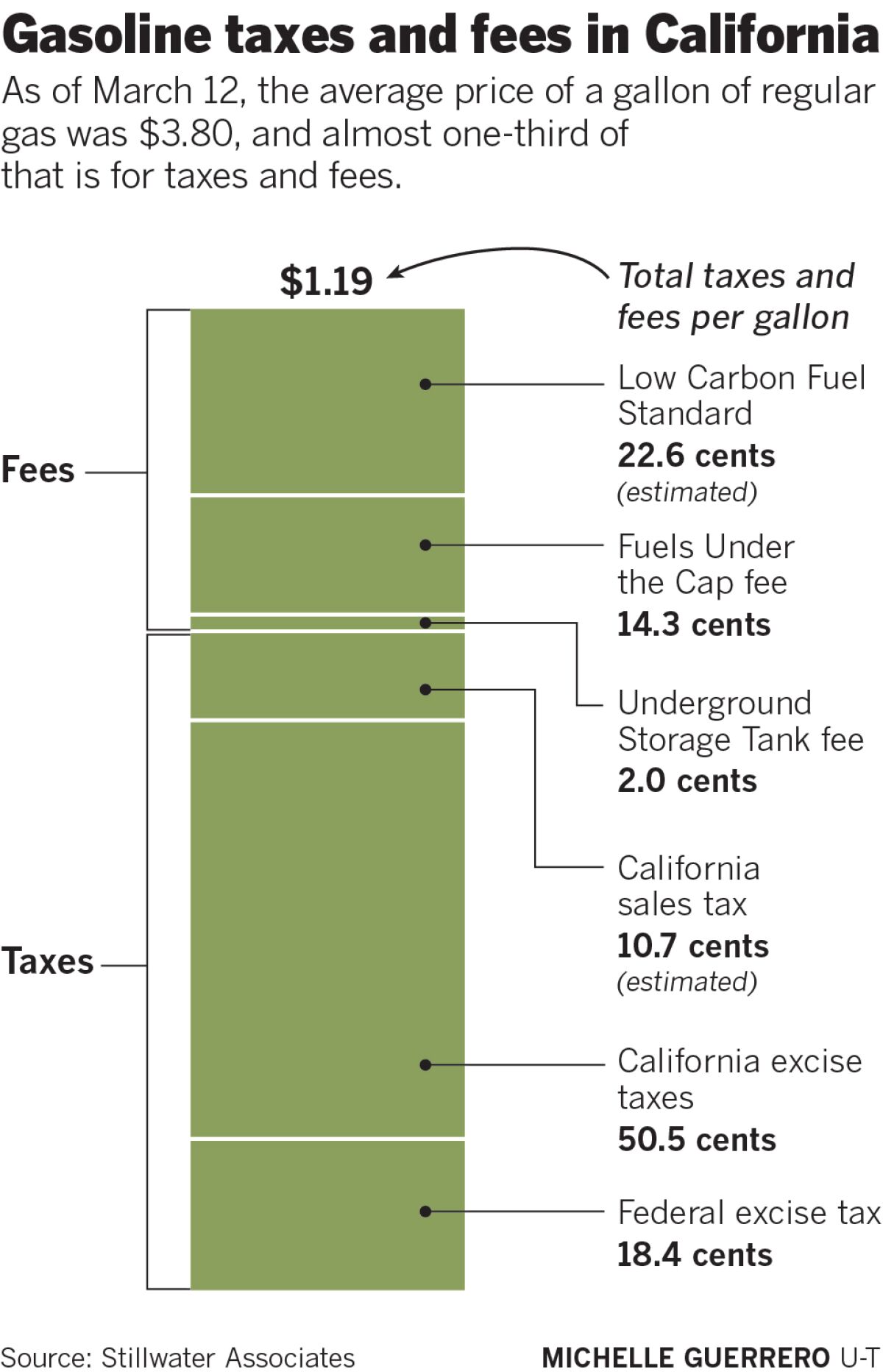

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

San Francisco County California Sales Tax Rate

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

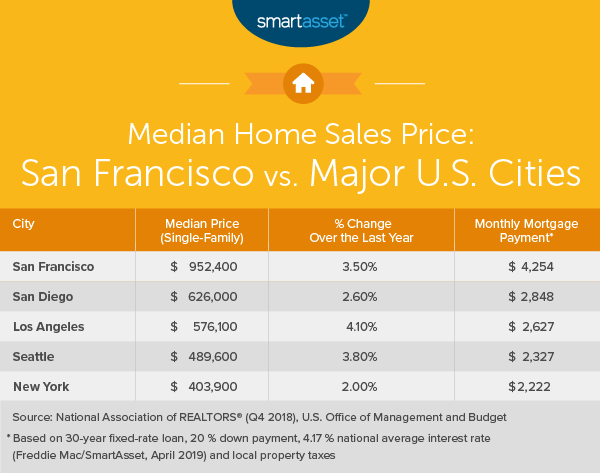

What Is The True Cost Of Living In San Francisco Smartasset

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California